Welcome to the 2nd Edition of the Re-Make Impact Evaluation section. For those of you who read the 1st Edition, the purpose of this article is already clear, but if you are new to my blogs, I recommend you to at least read the intro section of the first Impact Evaluation dedicated to the Sopwith Camel.

As you all probably know, 9516 Jabba's Palace set was the focus of investor and collector's attention a couple of months ago when news about its possible early retirement were spread through the news networks. In those crazy days, the set saw a huge spike in price as a result of panic buying and short term flippers that has since faded out. Now that everything is back to normal, I think it is important to remember that this version of Jabba's Palace is actually the second one released by LEGO, since back in 2003 the 4480 Jabba's Palace was introduced.

The older version of the Palace is obviously inferior to this current one, with a lot less detailing and lower quality minifigs. Back then, LEGO was still in the early years of what I think as of a huge jump in set design and quality, so the inferiority of the model is actually not that surprising. The older version included only around 200 pieces, but despite its small size and not great detailing the set actually performed great in the secondary market, with its highest point in the last 12 months reaching $ 170.

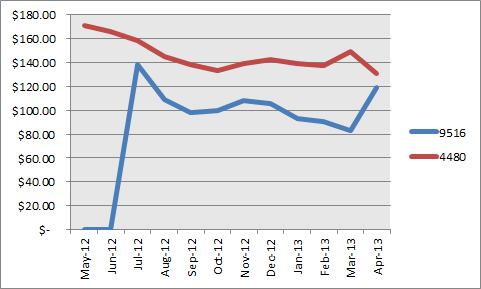

Let's now take a look at how the set has behaved since the newer version was released around mid-year 2012:

So, you can see on the graph that the trend for the old 4480 set has been negative for most of the time. We also have to consider that 9516 was made available in July, but that its official announcement was made some time before that. From the data, we see that over the past year alone 4480 has lost around 28% of its value, and currently sells for around $131. You may ask, how can we be so sure that the newer version is the cause of the sudden drop in value?, well there is no way to be completely sure without a very in depth analysis, but I can at least tell you that between the beginning of May 2011 through April 2012 the set lost only around 6 % of its value, while in the past year or so (May 2012 through April 2013) the set has lost that 28% we mentioned earlier. There is clearly some relation between the announcement and release of the new version and the sharp decrease in value of the old one.

Of all of the sets I have been evaluating for this section, this one of the sets that has experienced such a large drop in value following the new release. It will be interesting to see if it continues to drop further in the following months, but it is very clear that most investors would be better served by selling some of their stock just in case the 4480 continues this downward trend.

Recommended Comments

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.